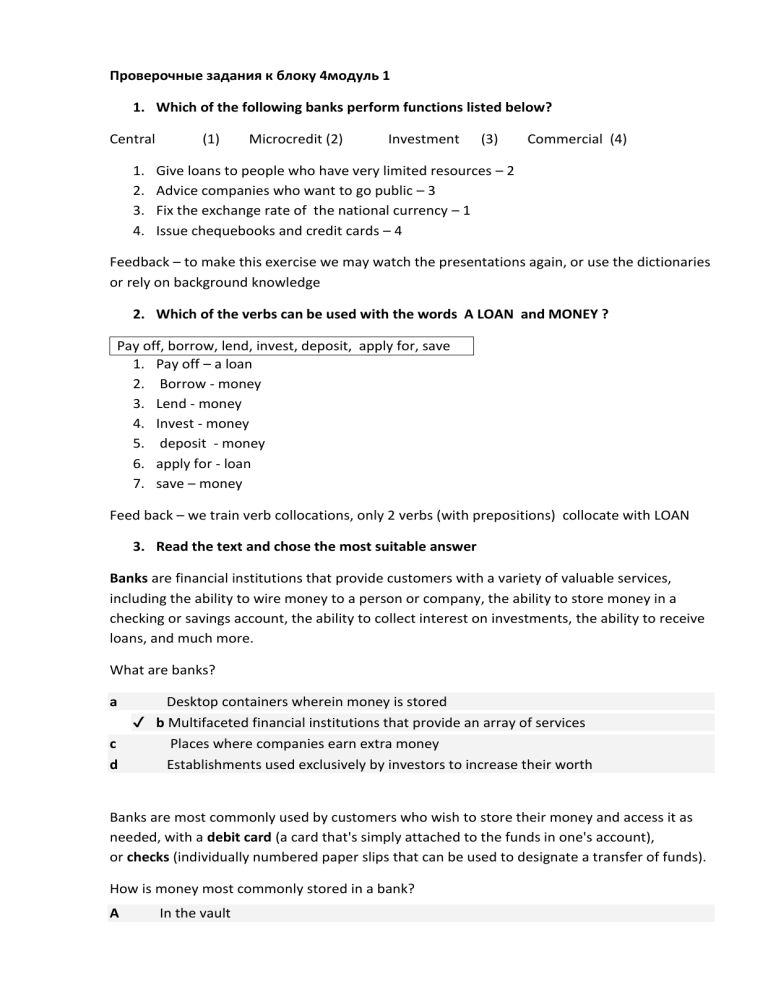

Проверочные задания к блоку 4модуль 1 1. Which of the following banks perform functions listed below? Central 1. 2. 3. 4. (1) Microcredit (2) Investment (3) Commercial (4) Give loans to people who have very limited resources – 2 Advice companies who want to go public – 3 Fix the exchange rate of the national currency – 1 Issue chequebooks and credit cards – 4 Feedback – to make this exercise we may watch the presentations again, or use the dictionaries or rely on background knowledge 2. Which of the verbs can be used with the words A LOAN and MONEY ? Pay off, borrow, lend, invest, deposit, apply for, save 1. Pay off – a loan 2. Borrow - money 3. Lend - money 4. Invest - money 5. deposit - money 6. apply for - loan 7. save – money Feed back – we train verb collocations, only 2 verbs (with prepositions) collocate with LOAN 3. Read the text and chose the most suitable answer Banks are financial institutions that provide customers with a variety of valuable services, including the ability to wire money to a person or company, the ability to store money in a checking or savings account, the ability to collect interest on investments, the ability to receive loans, and much more. What are banks? a Desktop containers wherein money is stored ✔ b Multifaceted financial institutions that provide an array of services c Places where companies earn extra money d Establishments used exclusively by investors to increase their worth Banks are most commonly used by customers who wish to store their money and access it as needed, with a debit card (a card that's simply attached to the funds in one's account), or checks (individually numbered paper slips that can be used to designate a transfer of funds). How is money most commonly stored in a bank? A In the vault B In the form of stocks and bonds ✔ In personal checking and savings accounts D In a number of safes Funds accumulated in banks are then used, along with their credit, to perform other functions and offer additional services. For example, many customers use banks to secure home mortgages, or multiyear loans through which ownership (or equity) of a home is achieved. What is a home mortgage? a b c A means through which banks pay customers for their home A complex home ownership plan sold by banks to clients Fees charged by a bank for home repair costs ✔ A loan commonly issued by banks that allows qualified clients to own their home, provided they offer a down payment and pay their monthly mortgage bill for the agreed upon period Feedback – we read the text carefully and if necessary look at the dictionary 4.Audio exercise Listen to the text and decide which statements are true or false. Cazenove is an American investment bank. – False Cazenove is finances many of Hollywood stars. – False The bank provides corporate finance advice. – True The bank charges little for its services. - True CAZENOVE, a small British investment bank, is the object of desire of many of the world’s biggest financial institutions. It is the banker for 43 for the UK’s top 100 companies and also manages the finances of many of the members of the British Royal Family. Cazenove provides corporate finance advice and manages funds on behalf of its clients worldwide. The bank acts as financial adviser in merger and acquisitions transactions, both public and private, and offers an extensive shareholder analysis service. Even though they are not specialists in all areas and charge relatively little for each of their services, when they announced they wanted to sell, all the major investment banks were interested in buying them. Feedback – we listen to the text and match the ideas, if necessary we may use the script. 5.Read the texts. Are these statements true or false? 1. A loan is a form of debt incurred by an individual or other entity. The lender—usually a corporation, financial institution, or government—advances a sum of money to the borrower. In return, the borrower agrees to a certain set of terms including any finance charges, interest, repayment date, and other conditions. In some cases, the lender may require collateral to secure the loan and ensure repayment. Loans may also take the form of bonds and certificates of deposit (CDs). 1. 2. 3. 4. A loan is a form of mortgage incurred (taken) by a person or a company – F The lender is usually a company, a bank, government or other official institution – T The borrower agrees to certain terms like interest, repayment date and others. – T Loans can never take the form of bonds, they can be only certificates of deposit. - F 2. Credit is an important financing option for both business and individuals. There are numerous forms of credit – but the individual borrowers usually use credits in a form of loans: a mortgage, a car loan or a student loan. The terms of the loan state how much your monthly payment will be and how long you’ll make payments. In other words, you make regular installments – or payments – towards the loan balance to the financial institution or lender. 1. 2. 3. 4. Credit plays an important role for businesses and individuals. – T There are not many forms of credit. – F The most popular forms of credit are a mortgage, a car credit and student loans. – T If you want to pay off the credit, you should make regular (monthly) payments. – T Feedback – we read the text carefully and if necessary look at the dictionary 6.Insert the most suitable verbs To keep, to offer, to lend, to protect, to become, to withdraw 1.___________________ money (to withdraw) 2.____________________ money safe for the customers (to keep) 3.______________ profitable (to become) 4._______________ customers interest on deposits (to offer) 5._______________ money to firms (to lend) 6._________________ money value against inflation (to protect) Feedback – the collocations are based on the material of the presentations 7. Audio exercise Listen and decide which of the statements are true or false 1. Credit is an arrangement that enables us to receive cash, goods or services now, with the understanding that we will pay for them in the future – True 2. Car loans and household mortgages are some of the most unpopular forms of credit. – False 3. Credit cards are not safe as a payment tool. – False 4. Credit provides a cushion in an emergency. – False 5. Overspending is one of the disadvantages of credit. – True 6. Credit shoppers often ignore sales and special offers. - True Obtaining and using credit Credit is an arrangement that enables us to receive cash, goods or services now, with the understanding that we will pay for them in the future. Charge accounts, credit cards, installment plans, car loans and household mortgages are some of the best known forms of credit. Like so many other things credits have their advantages and disadvantages. The principal advantages of credit are: Immediate possession. Credit enables us to enjoy goods and services immediately. Flexibility. Credit allows us to time our purchases so as to take advantage of sale items or other bargains even when your funds are low. Safety. Credit cards and change accounts provide a safe and convenient means of carrying our purchasing power with us while we are shopping or travelling. Emergency funds. Credit gives us a cushion in an emergency (like a car breakdown when money is needed to get back on the road). But there are also some considerable disadvantages. Overspending. Sometimes credit cards and charge accounts make it too easy to spend money. Then, as the debts mount, it becomes difficult to make all necessary monthly payments. Higher costs. Sometimes it costs more to buy on credit than for cash. One reason is that stores offering credit often charge more than those that sell only for cash. Another is that interest or other charges are often added to the cost of goods sold on credit. Untimely shopping. Credit shoppers ignore sales and special offers/ prices because they can buy what they want on credit whenever they want it. 8 Read the text and do the tasks CENTRAL BANKING SYSTEM The central banking system is a major sector of any modern 1_______ system. It is of great importance to the fiscal policy of the national government and the functioning of the private sector. Central banks such as the Bank of England, the Federal Reserve Board of the US, the Bundesbank of Germany, the Central Bank of Russia function for the government and other banks, not for private customers. They are responsible for the implementation of monetary 2 _______ and supervision over the banking system. In particular, they control the money 3 ______, fix the minimum 4 _______ rate, act as lenders of last resort to commercial banks with 5 _________ problems, issue coins and bank notes, influence exchange 6 __________ by intervening in foreign exchange markets. To ensure the safety of the banking system, central banks impose reserve requirements, obliging commercial banks 7 to _________ a certain amount of money with the central bank at zero interest. Central banks in different countries also impose different "prudential ratios" on commercial banks such as capital ratio and liquid ratio. In the course of market reforms in Russia the Central Bank has been pursuing moderately tight monetary policy aimed at further reduction of 8 _________ and putting an end to direct budget 9 __________ crediting. The CBR has been using the following main instruments of monetary policy: • 10 _________ targets for the money supply growth, • refinancing of commercial banks, • interest rates, • open 11 _______ operations, • commercial banks reserve requirements, • foreign 12 __________ control, • direct quantity restrictions. 1 A monetary B credit C currency 2 A course B strategy C policy 3 A delivery B input C supply 4 A percentage B interest C loan rate 5 A liquidity B cash C creditworthiness 6 A quotas B levels C rates 7 A install B deposit C place 8 A increase B inflation C rise 9 A limit B shortage C deficit 10 A fixed B stable C rigid 11 A finance B market C economy 12 A currency B coins Feedback: 1. monetary – a term, 2. policy- a part of a term, 3. supply - money supply – денежная масса 4. interest - interest rate - процентная ставка 5. liquidity – a term 6. rates - an exchange rate - обменный курс 7. deposit- a term 8. inflation – a term 9. deficit – a term 10. fixed – fixed targets – фиксированные цели\установки 11. market – open market – the only possible collocation 12. currency - again the term – if foreign – then currency 9. Insert the most suitable verb To possess, to have, to ensure, to prevent, to maintain, to avoid 1. _______________ misuse of banks (to avoid) 2. _______________ a monopoly (to possess) 3. _____________ the stability (to ensure) 4. ______________ price stability (to maintain) 5. _______________ bank runs (to prevent) 6. ______________ regulatory power (to have) Feedback – we train verb collocations used in the presentations 10. Choose the best options. 1) What is the official definition for sustainability? a) Understanding how to meet the needs of the present generation C money b) Understanding how to meet the needs of the present without compromising the needs of future generations to meet their own needs c) Understanding how to meet the needs of the future generations 2) What of the following elements does sustainable finance NOT include? a) Integration of environmental, social and shareholder factors b) Corporate engagement and shareholder action c) Approval by United Nations d) Best-in-case screening of investments 3) Investing to generate measurable social or environmental impact alongside financial returns is called: a) Socially responsible investing b) Impact investing c) Positive-changing investing 4) Which of the following investing categories fit into the framework of sustainable investing? a) Exclusion b) Integration c) Impact d) All of the above e) Philanthropy Feedback: impact investing - целевое социальное инвестирование 11. Match up the words and expressions with the definitions below. 1 triple bottom line 2 leverage 3 broad sustainable investing 4 socially responsible investing 5 green finance 6 corporate social responsibility Feedback: triple bottom line - концепция тройного критерия a) incorporating in the financial system the financial risks and opportunities presented by climate change and other environmental challenges b) to screen out investments in companies or industries that do not align with a client’s values (i.e. a negative screening process) c) an accounting framework that measures not only financial but also social and environmental performance, designed for companies to value their social and environmental profits and losses as well as financial ones d) a management concept whereby companies integrate social and environmental concerns in their business operations e) public finance in the form of loans, risk guarantees, insurance or private equity, used to encourage private investors to back a project by reducing its perceived risk f) a sustainable investing strategy that uses a general sustainability policy or approach rather than a product-specific policy, such as the seven strategies listed by GSIA, or a combination of them Feedback: align with - равняться; сравняться; соответствовать Feedback: accounting framework - система показателей учёта Keys: (1-c; 2-e; 3-f; 4-b; 5-a; 6-d; ) 12.Match the verbs with their definitions 1 Bribe A 2 embezzle B 3 forge C to make an illegal copy of something, especially a document or something in writing or a painting to get money illegally from a person or an organization by tricking them (more formal) to make a nearly exact copy of something valuable, so that people will think they are getting the real thing. 4 defraud D 5 fake E 6 counterfeit F 7 swindle G to make something false appear to be genuine, or a false situation appear to be real. to cheat somebody so as to to get money or something valuable from them (more informal) to steal money from your employer or money that you are responsible for to give somebody money or something valuable in order to persuade them to help you, especially by doing something dishonest Answers: 1G 2F 3A 4B 5D 6C 7E Feedback – the task is based on the vocabulary of the module. 13. Complete the table Verb - дано Noun (thing) ответы bribe embezzle forge defraud fake counterfeit swindle bribery embezzlement forgery fraud fake counterfeit swindle Noun –the person who does it ответы - дано embezzler forger fraudster faker counterfeiter swindler Adjective - ответы - дано - дано forged fraudulent fake counterfeit - дано Feedback – here we train the ways of word formation – pay attention to the suffixes we use to form nouns and adjectives (sure many of the words you already know) 14. Complete the sentences with the best word. 1. ____primarily affects business lending. A. ATM fraud B. Bank account fraud C. Card fraud D. Accounting fraud 2. In some cases, the scammers ___the username and password of a banking customer, and they wire money to themselves. A. mug B. burgle C. steal D. rob 3. _____includes everything from reprogramming the machine to installing a skimmer to steal card details. A. Card fraud B. ATM fraud C. ATM fraud D. Bank account fraud 4. ____is a method used by fraudsters to record information of people’s payment cards like debit and credit cards to conduct fraudulent transactions. A. Card skimming B. Card scanning C. Card reading D. Card removing 5. _____is a type of DLT in which transactions are recorded with an immutable cryptographic signature called a hash. A. Blockchain B. Chatbot C. AI chatbot D. Robotic process automation 6. _____is a program within a website or app that simulates human conversations using natural language processing. A. An AI chatbot B. Blockchain C. AI D. Robotics 7. The industry is witnessing a continued and aggressive focus on_____. A. digital B. digitization C. digitalization D. digitating 8. Cryptocurrencies such as Bitcoin, Ethereum and Ripple are slowly gaining____. A. credibility B. access C. traction D. power Feedback – all definitions are to be taken from the presentations material (from the part devoted to FRAUD) 15. Complete the sentences The people _____________ (who/that) we employ are very highly qualified. A counterfeiter is a person ___________ (who) copies goods in order to trick people. Organizations _____________ (that) are flexible can respond to changes. - Open banking _____________,(which) is becoming mainstream in the UK and Europe, shows an increase in the general public’s understanding. The Central Bank of the Russian Federation, _____________ (which) was established on the thirteenth of July 1990, is the successor to the State Security Committee of the USSR. Feedback – we train relative clauses – we may repeat the rules in the presentation 16. Complete the sentences with the best word. 1. It depends on ___he penetrated the bank’s data security and accessed sensitive information. A.how B. when C. where D.which 2. We’re not interested ___we get great jobs and that kind of thing, we just want to have a good time. A. in whether B. whether C. which D. how 3. The Swiss regulator, ____ commenced its activities on 1 January 2009, has published new rules on the security of client identifying data. A. In which B.who C.that D. which 4. The astronauts ___are reported to be very cheerful are expected to land on the moon shortly. A.which B. who C. in which D. when Feedback – we train how to join subordinate clauses – we may repeat the rules in the presentation. Also we have to determine the relations of the main and subordinate clause correctly.