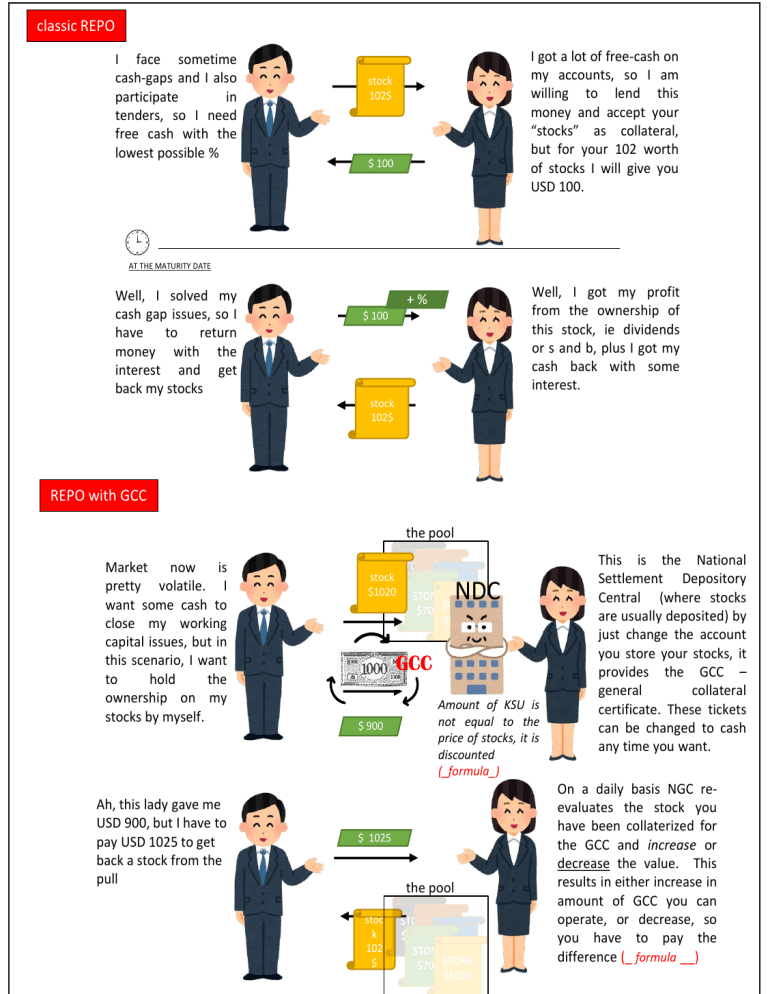

classic REPO I face sometime cash-gaps and I also participate in tenders, so I need free cash with the lowest possible % I got a lot of free-cash on my accounts, so I am willing to lend this money and accept your “stocks” as collateral, but for your 102 worth of stocks I will give you USD 100. stock 102$ $ 100 AT THE MATURITY DATE Well, I solved my cash gap issues, so I have to return money with the interest and get back my stocks Well, I got my profit from the ownership of this stock, ie dividends or s and b, plus I got my cash back with some interest. +% $ 100 stock 102$ REPO with GCC the pool Market now is pretty volatile. I want some cash to close my working capital issues, but in this scenario, I want to hold the ownership on my stocks by myself. Ah, this lady gave me USD 900, but I have to pay USD 1025 to get back a stock from the pull stock $1020 NDC GCC $ 900 Amount of KSU is not equal to the price of stocks, it is discounted (_formula_) $ 1025 the pool stoc k 102 $ This is the National Settlement Depository Central (where stocks are usually deposited) by just change the account you store your stocks, it provides the GCC – general collateral certificate. These tickets can be changed to cash any time you want. On a daily basis NGC reevaluates the stock you have been collaterized for the GCC and increase or decrease the value. This results in either increase in amount of GCC you can operate, or decrease, so you have to pay the difference (_ formula __)