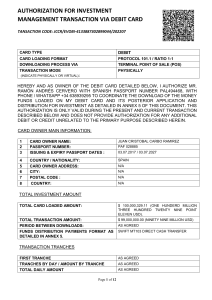

Vocabulary to debit – to take money from your account (e.g. ‘your account has been debited’) - снимать to credit – to add money to your account (e.g. ‘your account has been credited’) – докладывать деньги на текущий счет to be in credit – to have a positive bank balance – быть в плюсе one-off payment – a single payment that won’t necessarily be repeated – единоразовая плата commission – a charge paid, usually a percentage of the whole amount (a bureau de change will charge you commission to exchange your money – if you withdraw money at a foreign ATM, your credit card company will normally charge 3% of the total amount as commission) – комиссия to pay by installments – to pay back your loan in small amounts over a period of time – платить в рассрочку Barter Economy - moneyless economy that relies on trade or barter – экономика, базирующаяся на естественном обмене, бартерная экономика Commodity Money - money that has an alternative use as an economic good; gunpowder, flour, corn, etc. – товарные деньги Fiat Money - money by government dectee; has no alternative value or use as a commodity – бумажные деньги Demand Deposits Accounts (DDA's) - account whose funds can be removed from a bank or other financial institution by writing a check using a debit card – накопительный счет Legal Tender - currency that must be accepted for payment by decree of government – законная валюта Bank Run - sudden rush by depositors to withdraw all deposits funds, generally in antipation of bank failure or closure – массовое снятие вкладов населением Certificates of Deposit/ CD's - reciept showing that an investor has made an interest-bearing loan to a financial institution – депозитный сертификат account ATM balance bank charges banker's draft barter branch building society cashflow cashier chequebook cheque credit card n. a record of money a person deposits into a bank - счет n. Automatic Teller Machine aka Hole in the wall - банкомат n. the difference between credits and debits in an account - сальдо, остаток n. money paid to a bank for the bank's services etc – банковские сборы n. a cheque drawn on the bank (or building society) itself against either a cash deposit or funds taken directly from your own bank account. – банковский чек v. to trade without using money. - менять n. local office or bureau of a bank – отделение банка n. A building society is like a bank, but it is owned by its members - savers and borrowers - and not by shareholders. Its traditional purpose was to lend money to individuals to purchase or remortgage their homes. This money used to come exclusively from individual saving members who are paid interest on their deposits. Now, an increasing proportion, but still a minority of the funds are raised on the commercial money markets. – жилищно-строительный кооператив n. cash earnings minus cash outflows for fixed- and working-capital investment. – движение денежных средств n. an employee of a bank or building society who receives and pays out money. - касир n. book containing detachable cheques – чековая книжка n. written order to a bank to pay the stated sum from one's account - чек n. (plastic) card from a bank authorising the purchasing of goods on credit кредитка n. money that is used by a country such as the United Kingdom. - валюта n. bank a/c from which money may be drawn at any time; checking account US – текущий счет n. a sum deducted from a bank account, as for a cheque - also v. – дебет, расход n. you use a debit card in much the same way as a credit card but instead of debit card receiving credit after making your purchase, the funds are automatically (within a few days usually) withdrawn from your bank account. – дебитовая карта denomination n. a number that expresses the value of a coin or bill. A five pound note and a ten pound note represent two denominations. - единица n. an amount of money placed with a bank - вклад deposit deposit account n. bank a/c on which interest is paid; savings account US. – депозитный счет n. Used to describe the currency of other countries and the system for dealing in foreign such currency (often shortened to Forex). – обмен валюты exchange n. money paid for borrowing money, or money that a bank or building society interest pays a customer for putting money into their bank. - проценты n. the percentage of an amount of money which is paid for the use of that interest rate money over a period of time. – процентная ставка n. money lent by a bank etc and that must be repaid with interest - also v. - займ loan n. most of us do not buy our homes outright for cash - instead we borrow mortgage money to do so. - ипотека n. deficit in a bank account caused by withdrawing more money than is paid in overdraft – превышение кредита n. person to whom money is paid – получатель платежа payee standing order n. an instruction to a bank to make regular payments – регламент n. a record of transactions in a bank account – выписка счета statement v. to take money out of a bank account - снимать withdraw currency current account debit Mortgage - A loan for the purchase of real property, secured by a lien on the property. To make loans – выдавать кредиты demand deposit - a deposit of money that can be withdrawn without prior notice. A demand deposit consists of funds held in an account from which deposited funds can be withdrawn at any time from the depository institution, such as a checking or savings account, accessible by a teller, ATM or online banking. Commercial loan–коммерческий займ, коммерческий кредит Loan advanced to a business instead of to a consumer. checking account - A bank account in which checks may be written against amounts on deposit. financial intermediaries - финансовые посредники Financial institution (such as a bank, credit union, finance company, insurance company, stock exchange, brokerage company) which acts as the 'middleman' between those who want to lend and those who want to borrow. yield curve – кривая доходности is a line that plots the interest rates процентные ставки, at a set point in time, of bonds having equal credit quality but differing maturity dates. interest revenue - процентный доход is the earnings that an entity receives from any investments it makes, or on debt it owns. interest expense процентные расходы An interest expense is the cost incurred by an entity for borrowed funds. short-term deposit - an amount of money placed in a bank or financial institution for a term no longer than one year. long maturity loan – долгосрочный кредит The maturity date – срок погашения is the date on which the principal amount of a note, draft, acceptance bond or another debt instrument becomes due and is repaid to the investor and interest payments stop. asymmetric information – ассиметричная информация Asymmetric information occurs when one party to a transaction has more information about the deal than the other party. This situation most commonly arises when the seller of goods knows more about the goods than the buyer. Disparities of this type arise in situations where it is difficult to obtain information. credit risk – кредитный риск is the risk of loss by a person or entity that has extended credit to another party. off-balance-sheet – забалансовое, внебалансовое Off balance sheet refers to those assets and liabilities not appearing on an entity's balance sheet, but which nonetheless effectively belong to the enterprise. A balance sheet -баланс, балансовая ведомость lays out the ending balances in a company's asset, liability, and equity accounts as of the date stated on the report. Fee – пошлина, платаa payment made to a professional person or to a professional or public body in exchange for advice or services. safe deposit box – банковская ячейка, банковский сейф A safe deposit box is usually located inside a bank and is used to store valuables. A financial institution rents out safe deposit boxes, and they can be accessed with keys, pin numbers or some other type of security pass. Money center bank is similar in structure to a common bank; however, its borrowing and lending activities are with governments, large corporations, and regular banks. These types of financial institutions (or designated branches of these institutions) generally do not borrow from or lend to consumers. Regional bank региональный банк is a depository institution, i.e. a bank, savings and loan, or credit union, which is larger than a community bank, which operates below the state level, but smaller than a money center bank, which operates either nationally or internationally. A regional bank is one that operates in one region of a country, such as a state or within a group of states. Community bank is a depository institution that is typically locally owned and operated. Community banks tend to focus on the needs of the businesses and families where the bank holds branches and offices. Lending decisions are made by people who understand the local needs of families, businesses and farmers. Employees often reside within the communities they serve. credit union – Кредитный кооператив (кредитный союз или кооперативный банк) a nonprofit-making money cooperative whose members can borrow from pooled deposits at low interest rates. Credit unions follow a basic business model: Members pool their money – technically, they are buying shares in the cooperative – in order to be able to provide loans, demand deposit accounts, and other financial products and services to each other. Any income generated is used to fund projects and services that will benefit the community and interests of its members. non-profit-making money cooperative – некоммерческая финансовая организация A branch, banking center or financial center is a retail location where a bank, credit union, or other financial institution (including a brokerage firm) offers a wide array of face-to-face and automated services to its customers. retail customer – Розничный клиент In retail customer, in most of the cases (depends on what product it is) buyer and consumer is same or the only decision maker. IN corporate customer, a group of people takes a decision by keeping various factors, and in most of the cases buyer and consumers are different. saving account сберегательный счет, банковский депозит (вклад) A savings account is an interest-bearing deposit account held at a bank or other financial institution that provides a modest interest rate. The financial institutions may limit the number of withdrawals you can make from your savings account each month. They also may charge fees unless you maintain a certain average monthly balance in the account. In most cases banks do not provide checks with savings accounts A checking account is a deposit account held at a financial institution that allows withdrawals and deposits. Also called demand accounts or transactional accounts, checking accounts are very liquid and can be accessed using checks, automated teller machines and electronic debits, among other methods. With an interest-bearing checking account, the bank pays you interest on the money in your account, much like it pays interest on a savings account. However, with a checking account you can also write checks or use debit cards, making it easy to access your money as needed for bills, purchases and so forth. Money market deposit accounts are a cross between a checking and a savings account. They earn a bit more than interest-bearing checking accounts, but restrict the number of deposits or withdrawals that can be made each month. Bond is an official paper given by the government or a company to show that you have lent them money that they will pay back to you at aparticular interest rate (облигация) Conservatorship is a legal concept whereby a court appoints a person to manage an incapacitated person or minor's financial and personal affairs (опекунство, консервация) Liquidity is the fact of being available in the form of money, rather thaninvestments or property, or of being able to be changed into moneyeasily (ликвидность) Securities are investment in a company or in government debt that can betraded on the financial markets and produces an income for theinvestor (ценные бумаги) Recession is a period when the economy of a country is not successful andconditions for business are bad (спад, застой) Income Verification Letter is a document that is used to provide a legal proof of salary incomes for the verification purpose that usually occurs when you decide to apply for a bank account, credit card, loan, or for leasing conditions (справка о доходах) get in line – встать в очередь Bank teller is a person whose job is to pay out and take in money in a bank (банковский кассир) Put in you pin – ввести пароль Open an account – открыть счет Close an account – закрыть счет Checking account – банковский счет Savings account – сберегательный счет Debit card – дебетовая карта Transfer money from/to – перевести деньги Outline banking – онлайн банкинг Deposit money – внести деньги на счет Withdraw/take out money – снять деньги ATM machine – автомат Pay a bill – оплатить счет Exchange currency – обмен валюты What’s the rate? Какой курс? (валюты) 95 cents per dollar – 95 центов за доллар Get a credit card – получить кредитку Open a credit account – открыть кредитный счет Retirement savings – пенсионные сбережения